The California Tax Board Franchise is a critical regulatory body that oversees the taxation and licensing of businesses operating within the state. Understanding its functions and requirements is essential for any entrepreneur or business owner looking to operate legally and successfully in California. This guide will delve into the intricacies of the California Tax Board Franchise, providing valuable insights and actionable advice for businesses.

Operating a business in California comes with its own set of challenges, particularly when it comes to taxation and compliance. The California Tax Board Franchise plays a pivotal role in ensuring businesses adhere to state regulations, which can significantly impact their financial health and operational efficiency.

Whether you're a startup or an established business, this article aims to equip you with the knowledge and tools necessary to navigate the complexities of the California Tax Board Franchise. From understanding its structure to meeting its requirements, we'll cover everything you need to know to stay compliant and thrive in California's business environment.

Read also:Dwight Yoakam Biography A Journey Through Country Music Legend

Table of Contents

- Introduction to California Tax Board Franchise

- Key Functions of the California Tax Board Franchise

- The California Tax Board Franchise Registration Process

- Tax Filing Requirements

- Penalties for Non-Compliance

- Resources for Businesses

- Frequently Asked Questions

- Case Studies: Real-Life Examples

- Future Trends in California Taxation

- Conclusion and Next Steps

Introduction to California Tax Board Franchise

The California Tax Board Franchise, officially known as the California Franchise Tax Board (FTB), is a state agency responsible for administering state tax laws. Established to ensure fair and efficient tax collection, the FTB plays a crucial role in maintaining the financial integrity of businesses operating in California.

History of the FTB

The FTB has evolved significantly since its inception. Initially created to handle income tax matters, it now oversees a wide range of tax-related activities, including franchise taxes, payroll taxes, and other business-related levies. Understanding its historical context provides insight into its current operations and importance.

Importance for Businesses

For businesses, compliance with the FTB is not just a legal obligation but a strategic necessity. Failure to adhere to FTB regulations can result in severe penalties and financial setbacks. Thus, staying informed about its requirements is vital for long-term success.

Key Functions of the California Tax Board Franchise

The FTB performs several critical functions that directly impact businesses. These functions are designed to ensure fair taxation and compliance across the state.

- Administering state tax laws

- Collecting taxes from businesses and individuals

- Providing guidance and resources for tax compliance

- Enforcing penalties for non-compliance

Franchise Tax

One of the primary responsibilities of the FTB is the collection of franchise taxes. This tax applies to all corporations doing business in California and is calculated based on the company's net income and stock value.

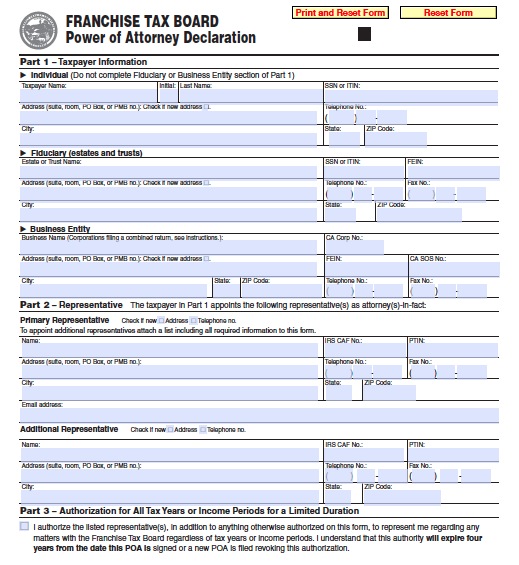

The California Tax Board Franchise Registration Process

Registering with the FTB is the first step for any business looking to operate in California. The process involves several steps, each designed to ensure businesses meet state requirements.

Read also:Mert Ramazan Rising Star In The World Of Entertainment

Steps to Register

- Complete the FTB 3522 form

- Provide necessary business documentation

- Pay any applicable fees

Timeline for Registration

The registration process typically takes several weeks, depending on the completeness of the application and the volume of submissions. It's important for businesses to start the process early to avoid delays in operations.

Tax Filing Requirements

Once registered, businesses must adhere to specific tax filing requirements set by the FTB. These requirements vary based on the type of business and its activities.

Annual Tax Filing

Most businesses are required to file annual tax returns with the FTB. These returns must include detailed financial information and be submitted by the specified deadline.

Quarterly Reporting

Some businesses, particularly those involved in payroll or sales, may also need to file quarterly reports. These reports ensure ongoing compliance and accurate tax assessment.

Penalties for Non-Compliance

Failure to comply with FTB regulations can result in significant penalties. These penalties are designed to encourage timely and accurate tax filings and discourage fraudulent activities.

Types of Penalties

- Late filing penalties

- Underpayment penalties

- Non-compliance penalties

How to Avoid Penalties

To avoid penalties, businesses should maintain accurate records, file taxes on time, and seek professional advice when needed. Staying informed about FTB regulations is also crucial for maintaining compliance.

Resources for Businesses

The FTB offers a variety of resources to help businesses navigate its regulations and requirements. These resources include online tools, educational materials, and customer support services.

Online Tools

The FTB website provides several online tools, such as tax calculators and filing portals, to assist businesses with their tax obligations.

Educational Materials

In addition to online tools, the FTB offers a range of educational materials, including guides, webinars, and workshops, to help businesses stay informed and compliant.

Frequently Asked Questions

Many businesses have questions about the FTB and its requirements. Below are some of the most frequently asked questions and their answers.

What is the Franchise Tax?

The franchise tax is a tax levied on all corporations doing business in California. It is calculated based on the company's net income and stock value.

How Often Do Businesses Need to File Taxes?

Most businesses are required to file annual tax returns, with some also needing to submit quarterly reports depending on their activities.

Case Studies: Real-Life Examples

Examining real-life examples of businesses interacting with the FTB can provide valuable insights into its operations and impact. Below are two case studies illustrating different scenarios.

Case Study 1: Small Business Compliance

A small startup successfully navigated the FTB registration and filing process, ensuring compliance and avoiding penalties.

Case Study 2: Large Corporation Challenges

A large corporation faced penalties due to non-compliance but rectified the situation through improved record-keeping and professional assistance.

Future Trends in California Taxation

As California continues to evolve, so too do its tax regulations. Keeping abreast of future trends is essential for businesses looking to remain competitive and compliant.

Technological Advancements

The FTB is increasingly leveraging technology to streamline its processes and improve service delivery. Businesses should be prepared to adapt to these advancements.

Policy Changes

Changes in state and federal policies can significantly impact FTB regulations. Staying informed about these changes is crucial for maintaining compliance.

Conclusion and Next Steps

In conclusion, understanding and complying with the California Tax Board Franchise is essential for any business operating in the state. By following the guidelines and utilizing available resources, businesses can ensure compliance and avoid costly penalties.

We encourage you to take action by reviewing your business's current compliance status and making any necessary adjustments. Don't hesitate to reach out to the FTB or consult with a tax professional for further guidance. Share this article with your network and explore other resources on our site to enhance your business knowledge.

References:

- California Franchise Tax Board Official Website

- IRS Guidelines for State Tax Compliance

- State of California Business Portal