Traveling abroad has become an integral part of modern life, and having the right financial tools is essential for a seamless experience. Navy Federal Credit Union offers a range of credit cards designed to meet the needs of its members, including those who frequently travel internationally. Understanding the Navy Federal Credit Card foreign transaction fee is crucial for making informed financial decisions when using your card abroad.

Whether you're exploring exotic destinations or simply conducting business overseas, credit cards play a pivotal role in managing expenses. However, not all credit cards are created equal, especially when it comes to international transactions. This article delves into the details of the Navy Federal Credit Card foreign transaction fee, helping you navigate potential costs and choose the best card for your needs.

Our goal is to equip you with the knowledge to optimize your credit card usage while traveling abroad. By understanding the fees associated with international transactions, you can avoid unexpected charges and enjoy a stress-free travel experience. Let's dive into the specifics of Navy Federal Credit Union's credit card offerings and their impact on foreign purchases.

Read also:Exploring The Connection Between Faith Hill And Taylor Swift

Table of Contents

- Overview of Navy Federal Credit Card

- Understanding Foreign Transaction Fees

- Detailed Breakdown of Navy Federal Foreign Transaction Fee

- Navy Federal Credit Card Options

- Strategies to Avoid Foreign Transaction Fees

- Additional Travel Benefits

- Comparison with Other Credit Unions

- Tips for Using Credit Cards Abroad

- Frequently Asked Questions

- Conclusion and Final Thoughts

Overview of Navy Federal Credit Card

Navy Federal Credit Union is one of the largest credit unions in the United States, serving over 11 million members. Their credit card offerings are designed to cater to the diverse needs of their members, including those who frequently travel abroad. Navy Federal Credit Cards provide a range of benefits, from cashback rewards to travel protections, making them a popular choice for both domestic and international users.

While Navy Federal Credit Cards offer numerous advantages, it's important to understand the potential fees associated with international transactions. These fees can significantly impact your travel budget if not managed properly. In the next section, we'll explore what foreign transaction fees are and how they apply to Navy Federal Credit Cards.

Why Choose Navy Federal Credit Union?

- Competitive interest rates

- Excellent customer service

- Wide range of card options tailored to different member needs

Understanding Foreign Transaction Fees

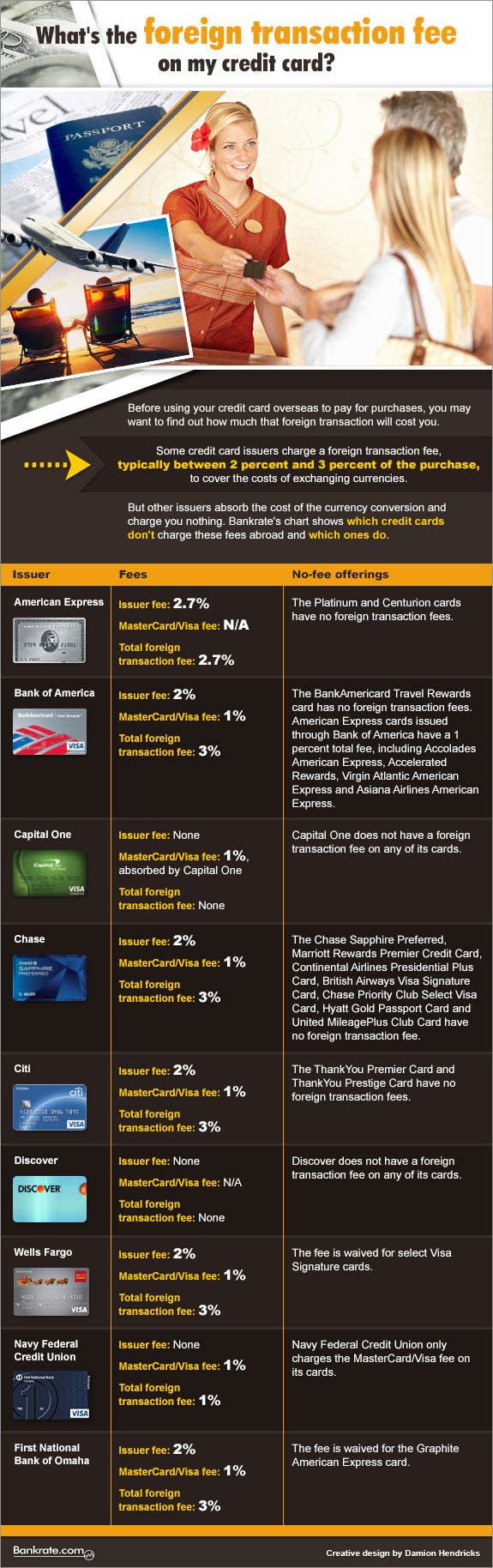

Foreign transaction fees are charges applied by credit card issuers when you make purchases in a foreign currency. These fees are typically a percentage of the transaction amount and can vary between different credit cards. Understanding how these fees work is essential for managing your finances while traveling abroad.

For Navy Federal Credit Card holders, the foreign transaction fee is an important consideration when planning international travel. By being aware of these fees, you can make informed decisions about which card to use and when to use it.

How Foreign Transaction Fees Are Calculated

Foreign transaction fees are usually calculated as a percentage of the transaction amount. For Navy Federal Credit Cards, this fee typically ranges from 1% to 3% of the purchase amount. The exact percentage depends on the specific card you're using and the terms set by the credit union.

Detailed Breakdown of Navy Federal Foreign Transaction Fee

Navy Federal Credit Union offers several credit card options, each with its own set of fees and benefits. Below is a detailed breakdown of the foreign transaction fees associated with some of their popular cards:

Read also:Post Malones Girlfriend A Deep Dive Into His Love Life

- Navy Federal Platinum Visa Card: 1% foreign transaction fee

- Navy Federal Cashback Rewards Visa Card: 3% foreign transaction fee

- Navy Federal Secured Card: No foreign transaction fee

It's important to note that these fees can vary, so always check the terms and conditions of your specific card for the most accurate information.

Navy Federal Credit Card Options

Navy Federal Credit Union offers a variety of credit cards to suit different member needs. Whether you're looking for a card with no foreign transaction fees or one that offers travel rewards, there's an option available for you. Below are some of the most popular Navy Federal Credit Cards:

1. Navy Federal Platinum Visa Card

This card offers a low foreign transaction fee of 1%, making it a great choice for frequent international travelers. It also provides travel accident insurance and a range of other benefits.

2. Navy Federal Cashback Rewards Visa Card

While this card has a higher foreign transaction fee of 3%, it offers generous cashback rewards on purchases. If you travel frequently and want to earn rewards, this card might be worth considering despite the fee.

3. Navy Federal Secured Card

For those looking to avoid foreign transaction fees altogether, the Navy Federal Secured Card is an excellent option. It has no foreign transaction fee and is ideal for building or rebuilding credit.

Strategies to Avoid Foreign Transaction Fees

While foreign transaction fees are a common feature of many credit cards, there are strategies you can use to minimize or even eliminate these charges. Here are some tips:

- Choose a card with no foreign transaction fees

- Use cash for small purchases to avoid unnecessary fees

- Plan your travel expenses and use the right card for each transaction

By carefully selecting the right credit card and managing your transactions, you can significantly reduce the impact of foreign transaction fees on your travel budget.

Additional Travel Benefits

Navy Federal Credit Cards offer more than just the ability to make purchases abroad. They also provide a range of travel benefits that can enhance your travel experience. Some of these benefits include:

- Travel accident insurance

- Rental car insurance

- Emergency assistance services

These additional benefits can provide peace of mind and added convenience when traveling internationally.

Comparison with Other Credit Unions

When considering Navy Federal Credit Union's foreign transaction fees, it's helpful to compare them with other credit unions and banks. While some institutions offer cards with no foreign transaction fees, others may have higher rates. Below is a comparison of Navy Federal's fees with those of other major credit unions:

- Pentagon Federal Credit Union: 1% foreign transaction fee

- USAA: 1% foreign transaction fee

- Bank of America: 3% foreign transaction fee

As you can see, Navy Federal's fees are competitive, especially when compared to some larger banks.

Tips for Using Credit Cards Abroad

Using credit cards while traveling abroad requires some preparation and strategy to ensure a smooth experience. Here are some tips to help you make the most of your Navy Federal Credit Card:

- Notify your credit union of your travel plans to avoid card restrictions

- Carry multiple forms of payment for backup

- Check the exchange rate and fees before making large purchases

By following these tips, you can enjoy a hassle-free travel experience and avoid unnecessary charges.

Frequently Asked Questions

Q: Can I avoid foreign transaction fees entirely?

A: Yes, some Navy Federal Credit Cards, like the Secured Card, have no foreign transaction fees. Choosing the right card is key to avoiding these charges.

Q: Are there any additional fees for using my Navy Federal Credit Card abroad?

A: Besides foreign transaction fees, there may be ATM withdrawal fees or currency conversion fees. Always check the terms and conditions of your specific card.

Q: Does Navy Federal offer travel insurance with their credit cards?

A: Yes, many Navy Federal Credit Cards come with travel accident insurance and other travel-related benefits.

Conclusion and Final Thoughts

Understanding the Navy Federal Credit Card foreign transaction fee is crucial for managing your finances while traveling abroad. By choosing the right card and employing strategies to minimize fees, you can enjoy a stress-free travel experience. Navy Federal Credit Union offers a range of cards with competitive fees and valuable travel benefits, making them a great choice for international travelers.

We encourage you to explore the options available and select the card that best suits your needs. Don't forget to leave a comment or share this article with others who may find it helpful. For more information on Navy Federal Credit Cards and their benefits, be sure to check out our other articles on the topic.